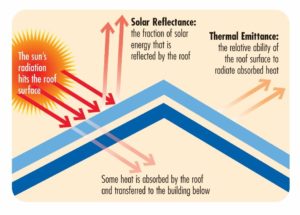

Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency.

Energy efficient doors tax credit 2016.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Use energy saver s reference list below to see if you are eligible for qualifying credits when filing irs tax form 5695 with your taxes.

At the end of 2016 the clock runs out on several federal tax credits for homeowners who made energy upgrades during the year.

500 for eligible doors.

Federal income tax credits and other incentives for energy efficiency.

Non business energy property credit.

Qualified improvements include adding insulation energy efficient exterior windows and doors and certain.

Simonton windows doors located at 5020 weston parkway suite 300 cary nc 27513 certifies that certain exterior windows and doors that are energy star qualified for the climate zone in which they are installed may be eligible for the tax credits as set forth in the extension of the american taxpayer relief act of 2013.

10 of cost up to 500 or a specific amount from 50 300 not including installation costs up to 200 for windows and skylights.

Solar wind geothermal and fuel cell technology are all eligible.

Claim the credits by filing form 5695 with your tax return.

Here are some key facts to know about home energy tax credits.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

December 31 2016 details.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

The following guidance is not intended as legal advice.

Up to 500 for doors.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

This is known as the residential renewable energy tax credit.

Federal tax credits for energy efficient windows and exterior doors were extended through 2016.

If you purchased and installed qualified new doors or windows between 2005 and december 31 2016 you may be able to take advantage of these tax credits.

Must be an existing home your principal residence.

See old 2016 tax credit information below.

Cumulative maximum tax credits for windows doors and skylights for all years combined is 500.

In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year.